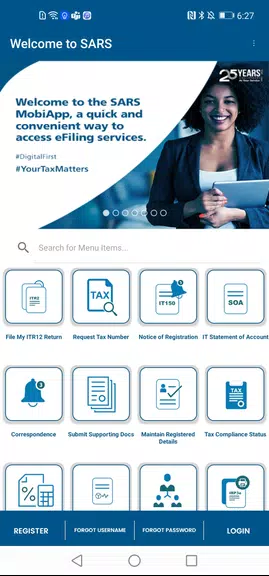

The SARS Mobile eFiling App revolutionizes tax administration in South Africa by providing taxpayers with a user-friendly platform to complete and submit Income Tax Returns from anywhere. Our innovative application enables seamless access to annual tax documents, offline editing capabilities, real-time assessment estimations, and submission status tracking - all while maintaining strict security measures for complete peace of mind.

Key Benefits of SARS Mobile eFiling:

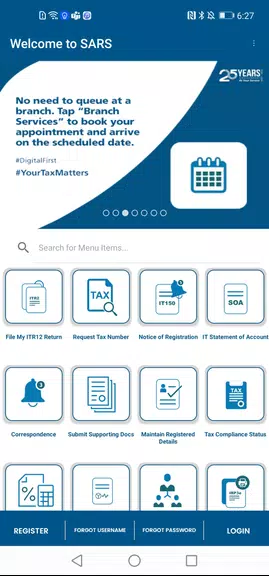

- Unprecedented Convenience: Submit your annual tax returns directly from your smartphone or tablet with our streamlined mobile interface.

- 24/7 Availability: Our mobile platform gives you complete control over your tax affairs whenever you need it, wherever you are.

- Bank-Level Security: All transmitted data receives government-grade encryption to protect your sensitive financial information.

- Smart Tax Calculator: Our integrated assessment tool provides accurate outcome predictions for better financial planning.

Frequently Asked Questions:

- Is the mobile platform secure for sensitive tax information?

Absolutely. We implement state-of-the-art security protocols matching those of financial institutions to safeguard your data. - Can I review previous years' tax records?

Yes, the app provides comprehensive access to your Notice of Assessment and Statement of Account history. - Does the app support business tax submissions?

Currently, our mobile solution exclusively supports individual taxpayers for personal income tax returns.

Final Recommendation:

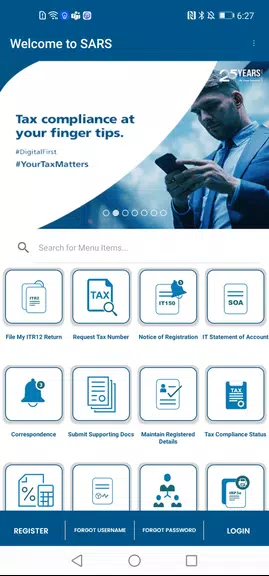

For South African taxpayers seeking a modernized, efficient approach to tax management, the SARS Mobile eFiling app delivers unmatched convenience without compromising security. This essential tool simplifies tax compliance for both experienced users and first-time filers alike. Install today to experience effortless tax administration at your fingertips.

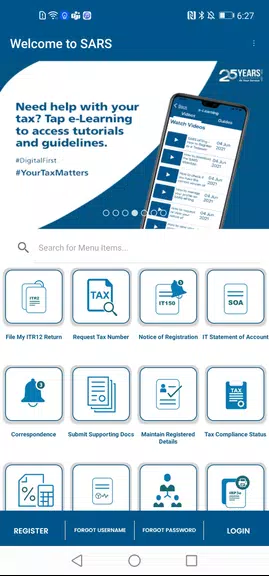

Screenshot