Afterpay - Buy Now, Pay Later is a financial technology application designed to offer users a flexible and convenient way to shop. By allowing purchases to be paid in installments, Afterpay enables consumers to buy now and pay later without incurring interest or fees. With partnerships across a diverse range of online and in-store retailers, Afterpay provides access to an extensive selection of products and services. Its intuitive interface and seamless checkout process make it a modern solution for today’s shoppers looking for smarter ways to manage their spending.

Key Features of Afterpay - Buy Now, Pay Later

- App-exclusive shopping perks: The Afterpay app delivers special deals and discounts, giving users exclusive access to a broad variety of brands and merchandise.

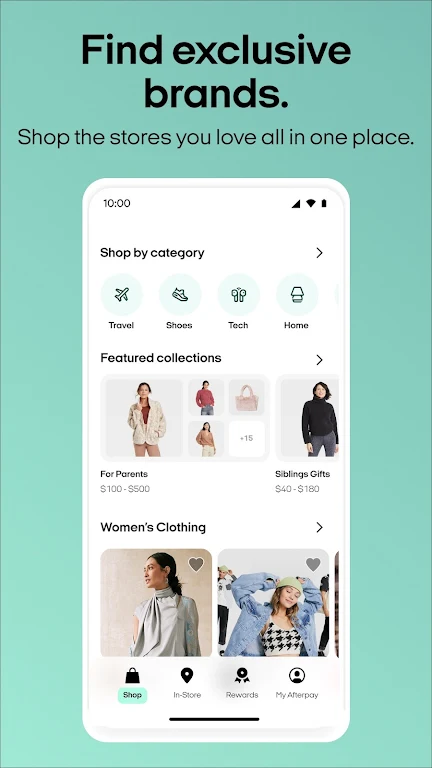

- Split into 4 interest-free payments: Break your purchase total into four manageable installments, simplifying budget control.

- Extended payment plans (6 or 12 months): For larger purchases, choose the option to spread payments over six or twelve months.

- Exclusive app-only brands: Discover and shop unique brands available only through the Afterpay platform.

Frequently Asked Questions

Is Afterpay accepted in physical stores?

Yes, Afterpay is usable at numerous retail locations, offering flexibility for both online and in-store shopping experiences.

How can I adjust my payment schedule?

Modify your payment plan, pause payments for returns, and monitor your order history directly within the app.

How do I get notified about sales and price drops?

Enable push notifications to stay informed on new sales and receive alerts when prices drop on items you're interested in.

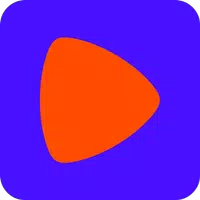

App-Exclusive Shopping Experience

The Afterpay app introduces a modern approach to shopping, accessible exclusively via mobile. It allows users to explore and purchase from a wide network of brand deals. Whether shopping online or in-store, users can divide their purchase into four interest-free installments. The app also supports browsing stores, brands, discounts, and gift cards across multiple categories including fashion, beauty, home goods, toys, and electronics.

Flexible Payment Plans

Afterpay now offers additional payment flexibility with installment options of 6 or 12 months at select merchants. This feature allows users to comfortably afford high-value items by spreading the cost over time—helping maintain better financial control.

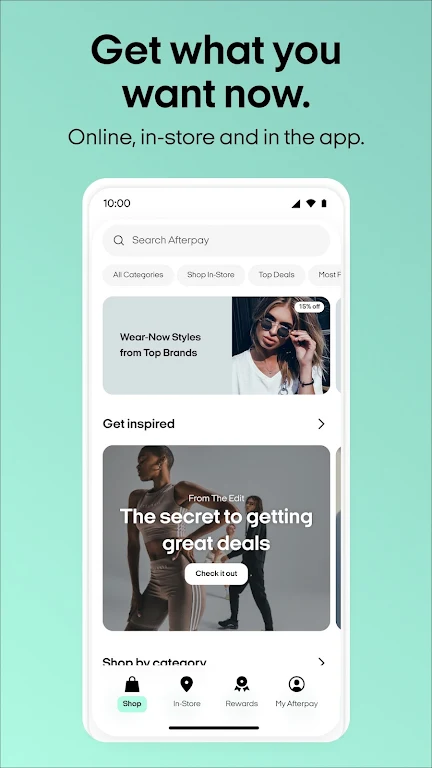

Unique Brands and Product Categories

Through the Afterpay app, users gain access to exclusive brands and product categories not found elsewhere. From fashion to tech, the app brings together distinctive and sought-after items. Daily curated shopping guides and trend-focused content keep users informed about the latest deals and must-have products.

Effortless Order Management

Managing orders and payments has never been easier. Users can review past and current transactions, modify payment dates, or pause payments during return processing. Additionally, integration with Cash App allows users to handle Afterpay orders seamlessly from within the Cash App platform.

Real-Time Sale and Price Drop Notifications

Stay ahead of the best deals with real-time push notifications for sales and price reductions. Save products inside the app and receive alerts as soon as prices go down—ensuring you always get the most value for your purchase.

In-Store Shopping Made Simple

Enjoy the convenience of using Afterpay at physical retail locations by adding your Afterpay card to your digital wallet. The app displays your pre-approved spending limit, helping you shop responsibly and stay within budget.

Eligibility for Higher Spending Limits

By consistently making timely payments, users may qualify for increased spending limits. Afterpay encourages responsible financial behavior and aims to support users in managing their budgets effectively.

Around-the-Clock Customer Support

Assistance is available anytime via the Afterpay app's customer support chat. Access frequently asked questions and get prompt help whenever needed.

Terms and Conditions Overview

To use Afterpay, users must accept the Terms of Use and Privacy Policy. Eligibility requires users to be at least 18 years old, a U.S. resident, and meet other qualifying criteria. In-store usage may require additional verification. Late fees may apply, and full terms are outlined in the installment agreement. Loans provided to California residents are made under a California Finance Lenders Law license.

The Pay Monthly program involves loans issued or arranged by First Electronic Bank, an FDIC member. A down payment may be required, and APRs vary between 6.99% and 35.99%, based on eligibility and merchant conditions. These loans involve a credit check and approval process, and are not available in all states. A valid debit card, accessible credit file, and agreement to final terms are prerequisites. Estimated monthly payments shown exclude taxes and shipping fees, which are added at checkout. Full terms are available on the Afterpay website.

Screenshot